Polymarket Data API - Build Prediction Market Apps in Minutes

Get real-time Polymarket data: prices, trades, markets, and oracle resolutions — all accessible through simple GraphQL queries on Polygon.

Quick Start: Get Polymarket Prices in 30 Seconds

Try it now: Open in Bitquery IDE → Paste query → Get instant results

Copy and paste this query to get the latest Polymarket trades with prices:

{

EVM(dataset: realtime, network: matic) {

Events(

orderBy: {descending: Block_Time}

where: {

Block: {Time: {since_relative: {hours_ago: 24}}}

Log: {Signature: {Name: {in: ["OrderFilled"]}}}

LogHeader: {

Address: {

in: [

"0xC5d563A36AE78145C45a50134d48A1215220f80a",

"0x4bFb41d5B3570DeFd03C39a9A4D8dE6Bd8B8982E"

]

}

}

}

limit: {count: 10}

) {

Block {

Time

Number

}

Transaction {

Hash

}

Arguments {

Name

Value {

... on EVM_ABI_BigInt_Value_Arg {

bigInteger

}

... on EVM_ABI_Address_Value_Arg {

address

}

}

}

}

}

}

What You Can Build

- Trading dashboards with real-time Polymarket prices

- Market discovery apps to find new prediction markets

- Analytics platforms tracking volume, liquidity, and trends

- Trading bots monitoring oracle resolutions and market movements

- Portfolio trackers for prediction market positions

Complete Guide: Get All Market Data

New to Polymarket APIs? Follow our step-by-step guide: How to Get All Data for a Specific Market — covers everything from market metadata to trades and token holders.

What is Polymarket API?

Polymarket API provides programmatic access to prediction market data through GraphQL queries. Query market information, trading activity, token holders, prices, and oracle resolution data directly from the Polygon blockchain.

What You Can Query

- Market prices — Real-time YES/NO prices from OrderFilled events

- Trading activity — All trades, order matches, and fills

- Market metadata — Titles, descriptions, outcomes (decoded from blockchain)

- Oracle resolutions — UMA oracle outcomes and dispute data

- Token holders — Who holds positions in each market

- Liquidity data — Position splits, merges, and collateral flows

Smart Contract Addresses

| Contract | Address | What It Does |

|---|---|---|

| Main Polymarket Contract | 0x4d97dcd97ec945f40cf65f87097ace5ea0476045 | Creates markets, mints/burns tokens, handles redemptions |

| CTF Exchange (Current) | 0xC5d563A36AE78145C45a50134d48A1215220f80a | Trading venue for outcome tokens (multi-outcome markets) |

| CTF Exchange (Legacy) | 0x4bFb41d5B3570DeFd03C39a9A4D8dE6Bd8B8982E | Legacy exchange for binary markets |

| UMA Adapter | 0x65070BE91477460D8A7AeEb94ef92fe056C2f2A7 | Connects Polymarket to UMA oracle for market resolution |

Common API Queries

- Get markets: Query

QuestionInitializedevents from UMA Adapter - Get prices: Query

OrderFilledevents from CTF Exchange - Get trades: Query

OrderFilledandOrderMatchedevents - Get condition ID: Query

ConditionPreparationevents from Main Contract - Decode market data: Decode

ancillaryDatafromQuestionInitializedevents

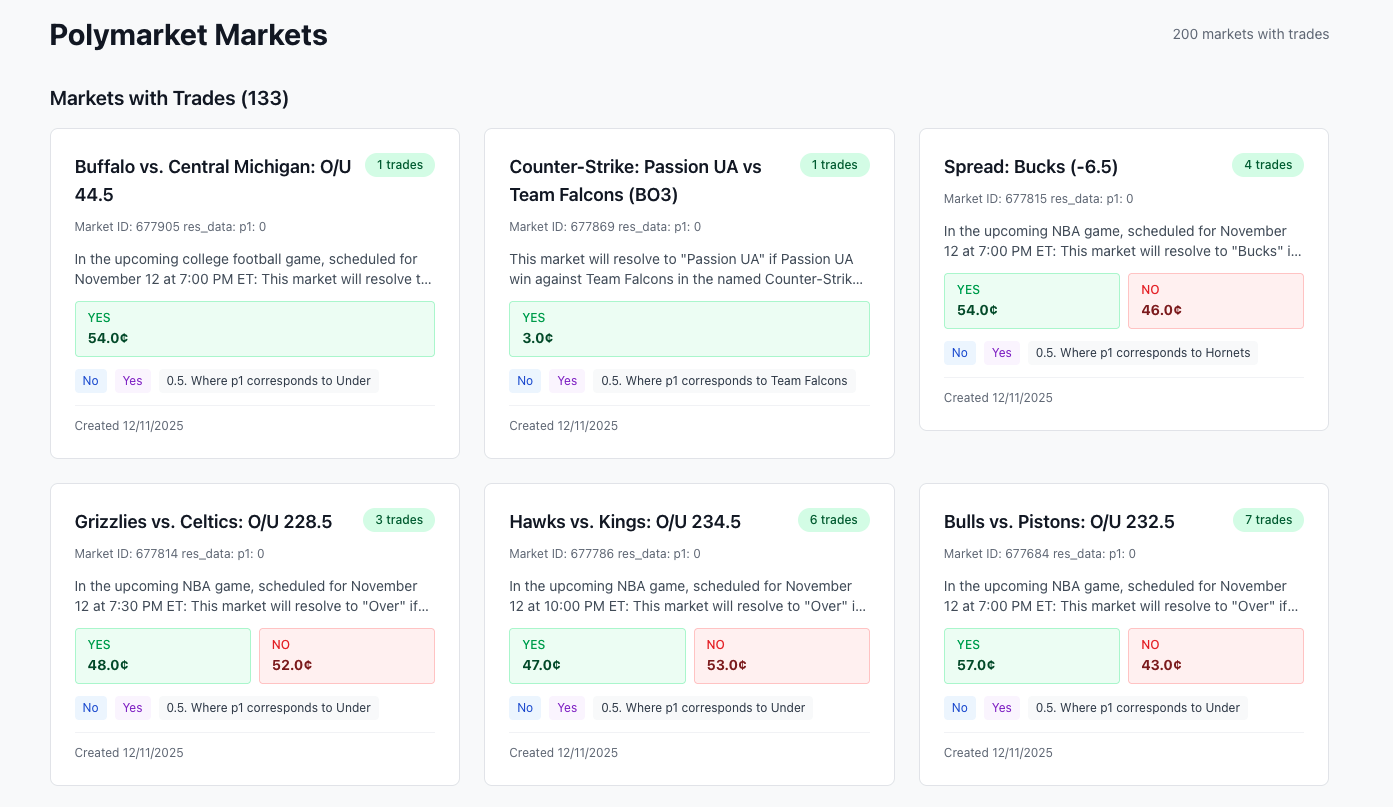

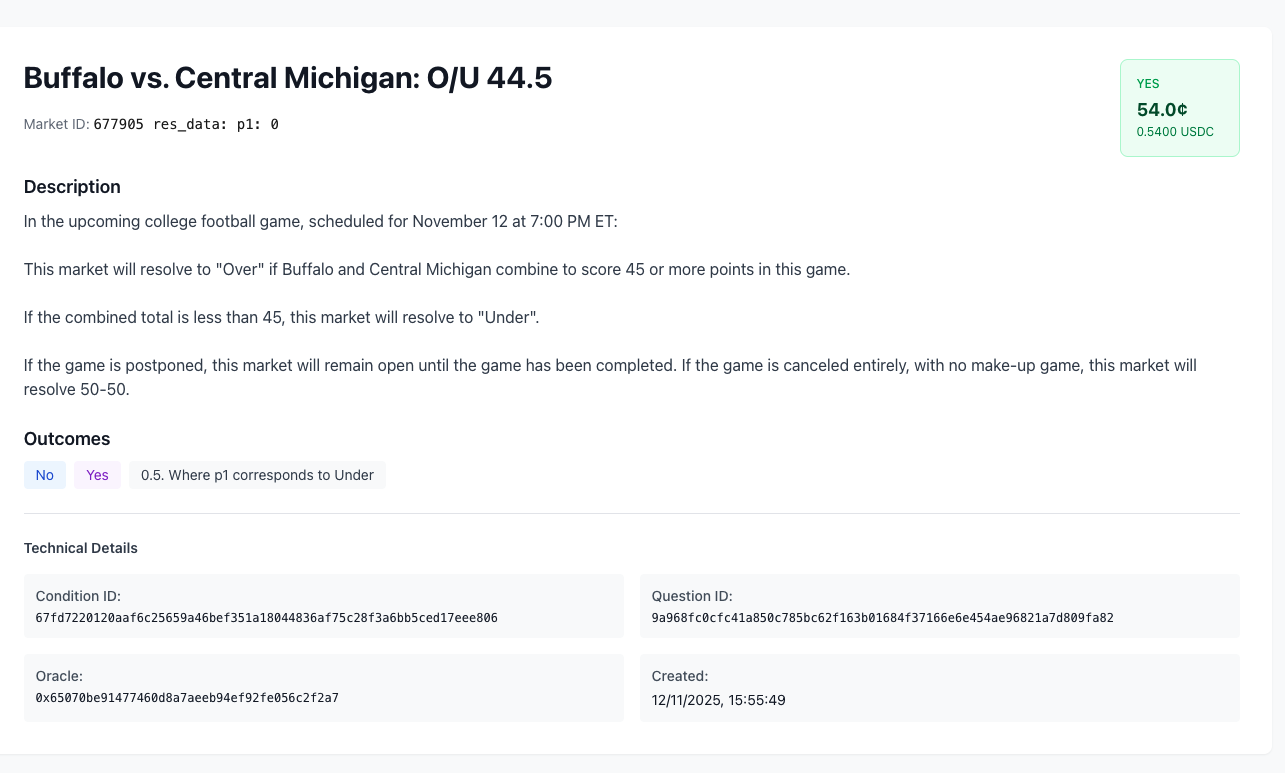

Real Example: Polymarket Dashboard

See it in action — a complete Next.js app built with these APIs:

Real-time market list with prices and trade counts

Real-time market list with prices and trade counts

Complete market view with metadata, prices, and technical details

Complete market view with metadata, prices, and technical details

What it does:

- Lists all Polymarket markets with live prices

- Shows trade history and token holders

- Decodes market metadata from blockchain

- Calculates prices from OrderFilled events

Tech stack: Next.js + TypeScript + Bitquery GraphQL APIs

CLI Tool: Polymarket Trade Tracker CLI — Built using Bitquery for inspecting OrderFilled events, tracking traders, and analyzing market data.

API Documentation by Contract

Choose the contract based on what data you need:

Main Polymarket Contract ��— Market Creation & Resolution

Use for: Creating markets, minting tokens, checking resolution status

Key Events:

ConditionPreparation— New markets createdPositionSplit— Tokens minted from collateralConditionResolution— Market resolved by oraclePayoutRedemption— Users claiming winnings

Address: 0x4d97dcd97ec945f40cf65f87097ace5ea0476045

CTF Exchange Contract — Trading & Prices

Use for: Getting prices, tracking trades, monitoring liquidity

Key Events:

OrderFilled— Individual trades (use for price calculation)OrderMatched— Order matching eventsTokenRegistered— New trading pairs created

Addresses:

- Current:

0xC5d563A36AE78145C45a50134d48A1215220f80a - Legacy:

0x4bFb41d5B3570DeFd03C39a9A4D8dE6Bd8B8982E

UMA Adapter Contract — Market Metadata

Use for: Getting market titles, descriptions, and question data

Key Events:

QuestionInitialized— New questions with metadata (decodeancillaryData)QuestionResolved— Oracle resolution outcomes

Address: 0x65070BE91477460D8A7AeEb94ef92fe056C2f2A7

Getting Started: 3 Steps to Your First Query

Step 1: Sign Up for Bitquery

Step 2: Choose What Data You Need

| What You Want | Which Contract | Which Event |

|---|---|---|

| Market prices | CTF Exchange | OrderFilled |

| New markets | UMA Adapter | QuestionInitialized |

| Market creation | Main Contract | ConditionPreparation |

| Trades | CTF Exchange | OrderFilled, OrderMatched |

| Market resolution | Main Contract | ConditionResolution |

Step 3: Copy a Query Template

Each contract documentation page includes ready-to-use GraphQL queries. Start with:

- Get all market data — Complete workflow

- CTF Exchange queries — Prices and trades

- Main Contract queries — Market lifecycle

Use Cases

Build a trading dashboard — Track prices, volume, and liquidity across all markets

Create a market explorer — Discover new prediction markets as they're created

Monitor oracle resolutions — Get alerts when markets resolve and track payout data

Analyze trading patterns — Study market maker behavior and trading flows

Market Lifecycle: How It Works

1. Market Created → ConditionPreparation event

2. Oracle Question → QuestionInitialized event

3. Tokens Minted → PositionSplit event

4. Trading Begins → OrderFilled events (prices update here)

5. Market Resolves → ConditionResolution event

6. Users Redeem → PayoutRedemption events

See the complete guide for step-by-step queries covering the entire lifecycle.

Quick Answers

Q: How do I get Polymarket prices?

A: Query OrderFilled events from CTF Exchange. Price = USDC paid / tokens received. See example →

Q: How do I find a market's condition ID?

A: Query ConditionPreparation events from Main Contract. The conditionId is in the event arguments. Full guide →

Q: How do I decode market titles and descriptions?

A: Query QuestionInitialized events, get ancillaryData, then decode hex to UTF-8. Decoding guide →

Q: How do I get all trades for a market?

A: Get token addresses from TokenRegistered events, then query OrderFilled events using those addresses. Step-by-step →

Q: What's the difference between the two exchange contracts?

A: Current (0xC5d5...) handles multi-outcome markets. Legacy (0x4bFb...) handles binary YES/NO markets. Query both for complete coverage.

Q: How do I know if a market is resolved?

A: Query ConditionResolution events. If found, market is resolved. If not, it's still open. Check resolution →

Additional Resources

- Polymarket Official Documentation

- UMA Oracle Documentation

- Conditional Token Framework

- Bitquery GraphQL API Documentation

Support

For technical support and questions:

- Join the Bitquery Telegram

Quick Reference

Contract Addresses:

- Main:

0x4d97dcd97ec945f40cf65f87097ace5ea0476045 - CTF Exchange (Current):

0xC5d563A36AE78145C45a50134d48A1215220f80a - CTF Exchange (Legacy):

0x4bFb41d5B3570DeFd03C39a9A4D8dE6Bd8B8982E - UMA Adapter:

0x65070BE91477460D8A7AeEb94ef92fe056C2f2A7

Network: Polygon (Matic)

API: Bitquery GraphQL — Try it now