DeFi Portfolio Scorer

This guide demonstrates how to build a DeFi Portfolio Scorer tool that analyzes Ethereum wallet address and calculates a DeFi Strategy Score based on transaction patterns, protocol interactions, and asset holdings using Bitquery APIs.

GitHub Repository: Defi-Portfolio-Profiler

Overview

The DeFi Portfolio Scorer is a Python-based analysis tool built with Bitquery APIs that calculates a DeFi Strategy Score (ranging from 25-100) for Ethereum wallet addresses. The score is based on four key pillars that measure different aspects of DeFi engagement:

Four Pillars of DeFi Strategy Score

-

P1: Transaction Count - Measures overall wallet activity

- 0-10 transactions = 0 points

- 100+ transactions = 100 points

- Linear interpolation between 10 and 100

-

P2: Transaction Types - Measures diversity of DeFi activities

- 1 type = 0 points

- 5+ types = 100 points

- Linear interpolation between 1 and 5

- Activity types include: Lending, Staking, Liquidity, Bridging, Yield Farming, ERC-20 Trading, NFT Trading

-

P3: Protocols Used - Measures ecosystem engagement

- 1 protocol = 0 points

- 8+ protocols = 100 points

- Linear interpolation between 1 and 8

- Tracks interactions with major DeFi protocols (Aave, Compound, Uniswap, Lido, RocketPool, Yearn, Convex, etc.)

-

P4: Assets Held - Measures portfolio diversity

- 1 asset = 0 points

- 15+ assets = 100 points

- Linear interpolation between 1 and 15

- Counts ERC-20 tokens with balance ≥ $10 USD and individual NFTs

Score Calculation

Formula: 25 (Base Score) + (Average Pillar Score × 0.75)

The final score ranges from 25 (minimum) to 100 (maximum), providing a comprehensive assessment of a wallet's DeFi engagement level.

Features

- Real-time Analysis: Uses Bitquery APIs to fetch live blockchain data

- Comprehensive Metrics: Analyzes transaction history, protocol interactions, and asset holdings

- Parallel Query Execution: Optimized performance using concurrent API calls

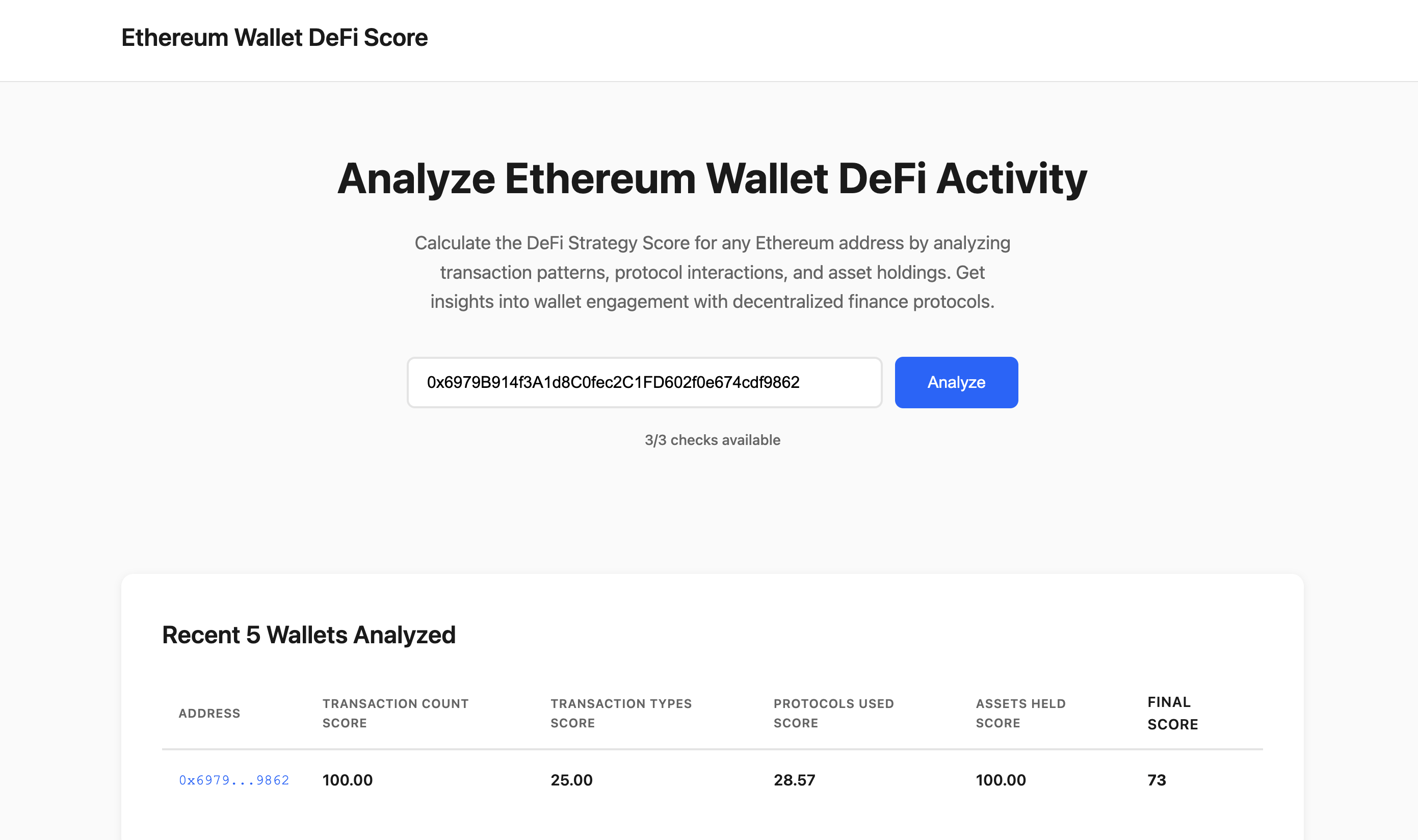

- Modern Web Interface: Clean, minimal UI with detailed score breakdown

- Command Line Interface: Terminal-based tool for quick analysis

- Recent Wallets Cache: Tracks up to 5 recently analyzed wallets

Prerequisites

- Python 3.7+ installed on your system

- Bitquery API Token - Get your API token here

- Basic understanding of Ethereum blockchain and DeFi protocols

Installation

- Clone the repository:

git clone https://github.com/Akshat-cs/Defi-Portfolio-Profiler

cd Defi-Portfolio-Profiler

- Install the required dependencies:

pip install -r requirements.txt

-

Set up your API key:

- Copy

.env.sampleto.env:

cp .env.sample .env- Edit

.envand replaceyour_api_key_herewith your actual Bitquery API key:

BITQUERY_API_KEY=BQ_your_actual_api_key_here - Copy

Project Structure

The project consists of two main files:

defi_tracker.py: Core analysis logic with GraphQL queries, scoring algorithms, and Bitquery API clientapp.py: Flask web application that provides the UI and API endpoints

How It Works

The tool uses multiple GraphQL queries from Bitquery APIs (both v1 and v2) to analyze wallet behavior:

- Transaction Count Query (P1): Fetches total transaction count from the last 3 years

- Protocol Interactions Query (P2/P3): Identifies smart contract calls to major DeFi protocols

- DEX and NFT Activity Query: Detects DEX swaps and NFT trading activity

- Asset Holdings Query (P4): Retrieves ERC-20 token balances (≥ $10) and NFT holdings

Code Walkthrough

1. Bitquery Client

The tool uses a custom BitqueryClient class to interact with Bitquery APIs:

class BitqueryClient:

"""Client for interacting with Bitquery GraphQL API"""

def __init__(self, api_key: str):

self.api_key = api_key

self.headers = {

"Content-Type": "application/json",

"Authorization": f"Bearer {api_key}",

}

def execute_query(self, query: str, variables: Optional[Dict] = None, endpoint: Optional[str] = None) -> Tuple[Dict, float]:

"""Execute a GraphQL query and return result with timing"""

payload = {

"query": query,

"variables": variables or {}

}

endpoint = endpoint or BITQUERY_ENDPOINT_V2

start_time = time.time()

response = requests.post(

endpoint,

json=payload,

headers=self.headers,

timeout=200

)

response.raise_for_status()

data = response.json()

elapsed_time = time.time() - start_time

return data.get("data", {}), elapsed_time

2. P1: Transaction Count Query

Fetches the total number of transactions sent by the address in the last 3 years:

def get_p1_transaction_count(client: BitqueryClient, address: str, time_3yr_ago: str) -> Tuple[int, float]:

"""Get transaction count for P1 using v1 API"""

query = """

query MyQuery($address: String, $time3yr_ago: ISO8601DateTime) {

ethereum {

transactions(

txSender: {is: $address}

time: {since: $time3yr_ago}

) {

count

}

}

}

"""

variables = {

"address": address,

"time3yr_ago": time_3yr_ago

}

data, elapsed_time = client.execute_query(query, variables, endpoint=BITQUERY_ENDPOINT_V1)

count = data.get("ethereum", {}).get("transactions", [{}])[0].get("count", 0)

return int(count) if count else 0, elapsed_time

3. P2/P3: Protocol Interactions Query

Identifies smart contract calls to major DeFi protocols and categorizes them:

def get_p2_p3_data(client: BitqueryClient, address: str, time_3yr_ago: str) -> Tuple[Set[str], Set[str], float]:

"""Get transaction types and protocols for P2 and P3 using v1 API"""

query = """

query MyQuery($time3yr_ago: ISO8601DateTime, $protocols: [String!], $address: String) {

ethereum(network: ethereum) {

smartContractCalls(

txFrom: {is: $address}

smartContractAddress: {in: $protocols}

time: {since: $time3yr_ago}

) {

smartContract {

address {

address

}

}

txc: count

}

}

}

"""

variables = {

"address": address,

"protocols": ALL_PROTOCOL_ADDRESSES, # List of major DeFi protocol addresses

"time3yr_ago": time_3yr_ago

}

data, elapsed_time = client.execute_query(query, variables, endpoint=BITQUERY_ENDPOINT_V1)

interacted_protocols = set()

activity_types = set()

calls = data.get("ethereum", {}).get("smartContractCalls", [])

for call in calls:

protocol_address = call.get("smartContract", {}).get("address", {}).get("address", "")

if protocol_address:

protocol_address_lower = protocol_address.lower()

interacted_protocols.add(protocol_address_lower)

# Categorize by protocol type

if any(addr.lower() == protocol_address_lower for addr in PROTOCOL_ADDRESSES["lending"]):

activity_types.add("Lending")

elif any(addr.lower() == protocol_address_lower for addr in PROTOCOL_ADDRESSES["staking"]):

activity_types.add("Staking")

elif any(addr.lower() == protocol_address_lower for addr in PROTOCOL_ADDRESSES["liquidity"]):

activity_types.add("Liquidity")

elif any(addr.lower() == protocol_address_lower for addr in PROTOCOL_ADDRESSES["bridging"]):

activity_types.add("Bridging")

elif any(addr.lower() == protocol_address_lower for addr in PROTOCOL_ADDRESSES["yield_farming"]):

activity_types.add("Yield Farming")

return activity_types, interacted_protocols, elapsed_time

The tool tracks major DeFi protocols organized by category:

- Lending: Aave (v2, v3), Compound (v2, v3), Sparklend, Morpho

- Staking: Lido, RocketPool

- Liquidity: Uniswap V3

- Bridging: Across, Stargate

- Yield Farming: Yearn Finance, Convex Finance

4. DEX and NFT Activity Query

Detects DEX swaps and NFT trading using the v2 API:

def get_dex_and_nft_activity(client: BitqueryClient, address: str) -> Tuple[int, int, Set[str], float]:

"""Get DEX swaps and NFT trading activity using v2 API"""

query = """

query TraderDexMarketsEvm($network: evm_network!, $trader: String!) {

EVM(network: $network) {

DEXTradeByTokens(

where: {

TransactionStatus: {Success: true}

Block: {Time: {since_relative: {years_ago: 3}}}

any: [

{Trade: {Seller: {is: $trader}}}

{Trade: {Buyer: {is: $trader}}}

]

}

) {

dex_count_fungible: count(

distinct: Trade_Dex_ProtocolName

if: {Trade: {Currency: {Fungible: true}}}

)

dex_count_nonfungible: count(

distinct: Trade_Dex_ProtocolName

if: {Trade: {Currency: {Fungible: false}}}

)

}

}

}

"""

variables = {"network": "eth", "trader": address}

data, elapsed_time = client.execute_query(query, variables, endpoint=BITQUERY_ENDPOINT_V2)

trades = data.get("EVM", {}).get("DEXTradeByTokens", [{}])[0]

dex_count_fungible = int(trades.get("dex_count_fungible", "0") or 0)

dex_count_nonfungible = int(trades.get("dex_count_nonfungible", "0") or 0)

# Add activity types based on counts

if dex_count_fungible > 0:

activity_types.add("ERC-20 Trading")

if dex_count_nonfungible > 0:

activity_types.add("NFT Trading")

return dex_count_fungible, dex_count_nonfungible, dex_protocols, elapsed_time

5. P4: Asset Holdings Query

Retrieves ERC-20 tokens with balance ≥ $10 and NFT holdings:

def get_p4_assets(client: BitqueryClient, address: str) -> Tuple[int, float]:

"""Get unique assets count for P4 (ERC-20 > $10 + NFTs) using v2 API"""

# ERC-20 tokens query

erc20_query = """

query MyQuery($address: String) {

EVM(network: eth, dataset: combined) {

BalanceUpdates(

orderBy: {descendingByField: "Balance_usd"}

where: {

BalanceUpdate: {Address: {is: $address}}

Currency: {Fungible: true}

}

) {

Currency {

Name

Symbol

SmartContract

}

Balance: sum(of: BalanceUpdate_Amount selectWhere: {gt: "0"})

Balance_usd: sum(of: BalanceUpdate_AmountInUSD selectWhere: {ge: "10"})

}

}

}

"""

# NFT balances query

nft_query = """

query MyQuery($address: String) {

EVM(dataset: combined, network: eth) {

BalanceUpdates(

where: {

BalanceUpdate: {Address: {is: $address}}

Currency: {Fungible: false}

}

orderBy: {descendingByField: "balance"}

) {

Currency {

Name

Symbol

SmartContract

}

balance: sum(of: BalanceUpdate_Amount)

}

}

}

"""

unique_assets = set()

nft_count = 0

# Get ERC-20 tokens (only count those with Balance_usd >= $10)

erc20_data, _ = client.execute_query(erc20_query, {"address": address}, endpoint=BITQUERY_ENDPOINT_V2)

balances = erc20_data.get("EVM", {}).get("BalanceUpdates", [])

for balance in balances:

balance_usd = balance.get("Balance_usd")

if balance_usd: # Only if >= $10

contract = balance.get("Currency", {}).get("SmartContract", "")

if contract:

unique_assets.add(contract)

# Get NFTs (count individual NFTs, not collections)

nft_data, _ = client.execute_query(nft_query, {"address": address}, endpoint=BITQUERY_ENDPOINT_V2)

nft_balances = nft_data.get("EVM", {}).get("BalanceUpdates", [])

for nft_balance in nft_balances:

balance_str = nft_balance.get("balance", "0")

try:

balance_value = int(float(balance_str))

nft_count += balance_value

except (ValueError, TypeError):

pass

# Total assets = ERC-20 tokens + individual NFT count

total_assets = len(unique_assets) + nft_count

return total_assets, total_time

6. Score Calculation Functions

Each pillar has a dedicated scoring function:

def calculate_p1_score(tx_count: int) -> float:

"""Calculate P1 score based on transaction count"""

if tx_count <= 10:

return 0.0

if tx_count >= 100:

return 100.0

# Linear interpolation between 10 and 100

return min(100.0, ((tx_count - 10) / (100 - 10)) * 100.0)

def calculate_p2_score(unique_types: int) -> float:

"""Calculate P2 score based on unique transaction types"""

if unique_types <= 1:

return 0.0

if unique_types >= 5:

return 100.0

# Linear interpolation between 1 and 5

return min(100.0, ((unique_types - 1) / (5 - 1)) * 100.0)

def calculate_p3_score(unique_protocols: int) -> float:

"""Calculate P3 score based on unique protocols used"""

if unique_protocols <= 1:

return 0.0

if unique_protocols >= 8:

return 100.0

# Linear interpolation between 1 and 8

return min(100.0, ((unique_protocols - 1) / (8 - 1)) * 100.0)

def calculate_p4_score(unique_assets: int) -> float:

"""Calculate P4 score based on unique assets held"""

if unique_assets <= 1:

return 0.0

if unique_assets >= 15:

return 100.0

# Linear interpolation between 1 and 15

return min(100.0, ((unique_assets - 1) / (15 - 1)) * 100.0)

7. Main Score Calculation

The main function orchestrates parallel queries and calculates the final score:

def calculate_defi_score(address: str, api_key: str, verbose: bool = True) -> Dict:

"""Calculate DeFi Strategy Score for an address"""

client = BitqueryClient(api_key)

time_3yr_ago = get_time_3_years_ago()

# Run queries in parallel for performance

with ThreadPoolExecutor(max_workers=4) as executor:

futures = {

"p1": executor.submit(get_p1_transaction_count, client, address, time_3yr_ago),

"p2_p3": executor.submit(get_p2_p3_data, client, address, time_3yr_ago),

"dex_nft": executor.submit(get_dex_and_nft_activity, client, address),

"p4": executor.submit(get_p4_assets, client, address),

}

# Collect results as they complete

results = {}

for future in as_completed(futures.values()):

name = [k for k, v in futures.items() if v == future][0]

results[name] = future.result()

# Process results and calculate scores

tx_count, _ = results["p1"]

p1_score = calculate_p1_score(tx_count)

activity_types, interacted_protocols, _ = results["p2_p3"]

dex_count_fungible, dex_count_nonfungible, dex_protocols, _ = results["dex_nft"]

# Add DEX protocols to P3

interacted_protocols.update(dex_protocols)

# Add activity types from DEX/NFT

if dex_count_fungible > 0:

activity_types.add("ERC-20 Trading")

if dex_count_nonfungible > 0:

activity_types.add("NFT Trading")

unique_types = len(activity_types)

unique_protocols = len(interacted_protocols)

p2_score = calculate_p2_score(unique_types)

p3_score = calculate_p3_score(unique_protocols)

unique_assets, _ = results["p4"]

p4_score = calculate_p4_score(unique_assets)

# Calculate final score

avg_pillar_score = (p1_score + p2_score + p3_score + p4_score) / 4.0

final_score = 25 + (avg_pillar_score * 0.75)

final_score_rounded = round(final_score)

return {

"address": address,

"p1": {"tx_count": tx_count, "score": p1_score},

"p2": {"unique_types": unique_types, "score": p2_score},

"p3": {"unique_protocols": unique_protocols, "score": p3_score},

"p4": {"unique_assets": unique_assets, "score": p4_score},

"average_pillar_score": avg_pillar_score,

"final_score": final_score,

"final_score_rounded": final_score_rounded

}

8. Web Application (Flask)

The Flask app (app.py) provides a REST API endpoint:

@app.route('/api/calculate', methods=['POST'])

def calculate():

"""API endpoint to calculate DeFi score"""

data = request.get_json()

address = data.get('address', '').strip()

# Validate address format

if not address.startswith('0x') or len(address) != 42:

return jsonify({'error': 'Invalid Ethereum address format'}), 400

# Get API key

api_key = os.getenv('BITQUERY_API_KEY')

if not api_key:

return jsonify({'error': 'API key not configured'}), 500

# Calculate score

result = calculate_defi_score(address, api_key, verbose=True)

# Store in recent wallets cache (max 5)

global recent_wallets

recent_wallets = [w for w in recent_wallets if w['address'].lower() != address.lower()]

recent_wallets.insert(0, {

'address': result['address'],

'p1': result['p1']['score'],

'p2': result['p2']['score'],

'p3': result['p3']['score'],

'p4': result['p4']['score'],

'final_score': result['final_score_rounded']

})

recent_wallets = recent_wallets[:5]

return jsonify({

'success': True,

'data': result

})

Running the Tool

Option 1: Web UI (Recommended)

- Start the Flask web server:

python app.py

-

Open your browser and navigate to

http://localhost:5001 -

Enter an Ethereum address in the search box

-

Click "Analyze" to calculate the DeFi Strategy Score

The web UI features:

- Clean, minimal interface

- Real-time score calculation

- Detailed breakdown of all four pillars

- Recent wallets history (last 5 analyzed)

- Responsive design

Option 2: Command Line

Run the analysis directly from the command line:

python defi_tracker.py 0x6979B914f3A1d8C0fec2C1FD602f0e674cdf9862

The CLI output includes:

- Detailed query execution timing

- Individual pillar scores and metrics

- Final DeFi Strategy Score

- Debug information for troubleshooting

Understanding the Output

Score Breakdown

The tool provides a comprehensive breakdown:

- P1 Score: Transaction count and corresponding points

- P2 Score: Number of unique activity types and corresponding points

- P3 Score: Number of unique protocols interacted with and corresponding points

- P4 Score: Number of unique assets held and corresponding points

- Average Pillar Score: Average of all four pillar scores

- Final DeFi Strategy Score: Calculated using the formula

25 + (Average × 0.75)

Example Output

============================================================

DEFI STRATEGY SCORE RESULTS

============================================================

Address: 0x6979B914f3A1d8C0fec2C1FD602f0e674cdf9862

Pillar Scores:

P1 (Transaction Count): 85.50 points (95 transactions)

P2 (Transaction Types): 75.00 points (4 types)

P3 (Protocols Used): 62.50 points (6 protocols)

P4 (Assets Held): 90.00 points (12 assets)

Average Pillar Score: 78.25

Final DeFi Strategy Score: 84

============================================================

API Endpoints

The Flask web application provides the following endpoints:

POST /api/calculate

Calculates the DeFi Strategy Score for an Ethereum address.

Request Body:

{

"address": "0x6979B914f3A1d8C0fec2C1FD602f0e674cdf9862"

}

Response:

{

"success": true,

"data": {

"address": "0x6979B914f3A1d8C0fec2C1FD602f0e674cdf9862",

"p1": {

"tx_count": 95,

"score": 85.5

},

"p2": {

"unique_types": 4,

"score": 75.0

},

"p3": {

"unique_protocols": 6,

"score": 62.5

},

"p4": {

"unique_assets": 12,

"score": 90.0

},

"average_pillar_score": 78.25,

"final_score": 83.6875,

"final_score_rounded": 84

}

}

GET /api/recent

Returns a list of recently analyzed wallets (max 5).

Response:

{

"success": true,

"data": [

{

"address": "0x6979B914f3A1d8C0fec2C1FD602f0e674cdf9862",

"p1": 85.5,

"p2": 75.0,

"p3": 62.5,

"p4": 90.0,

"final_score": 84

}

]

}

Important Considerations

- Time Window: The analysis looks at the last 3 years of activity

- Asset Threshold: Only ERC-20 tokens with balance ≥ $10 USD are counted in P4

- NFT Counting: Individual NFTs are counted (not collections) in P4

- Protocol Coverage: The tool tracks major DeFi protocols but may not include all protocols

- API Rate Limits: Subject to Bitquery API rate limits and quota restrictions

- Query Performance: Queries are executed in parallel for optimal performance

- Data Accuracy: Scores are based on on-chain data available through Bitquery APIs

Use Cases

This tool is useful for:

- Portfolio Analysis: Understand your own DeFi engagement level

- Wallet Research: Analyze other wallets for due diligence or research

- DeFi Strategy Assessment: Evaluate how diversified and active a wallet's DeFi strategy is

- Learning Tool: Understand how to query and analyze Ethereum blockchain data using Bitquery

- Foundation for Advanced Tools: Use this as a starting point to build more sophisticated analysis systems

Support

For questions or issues:

- Check the GitHub repository for updates and issues

- Contact Bitquery support via Telegram or create a ticket here